Business

Finance

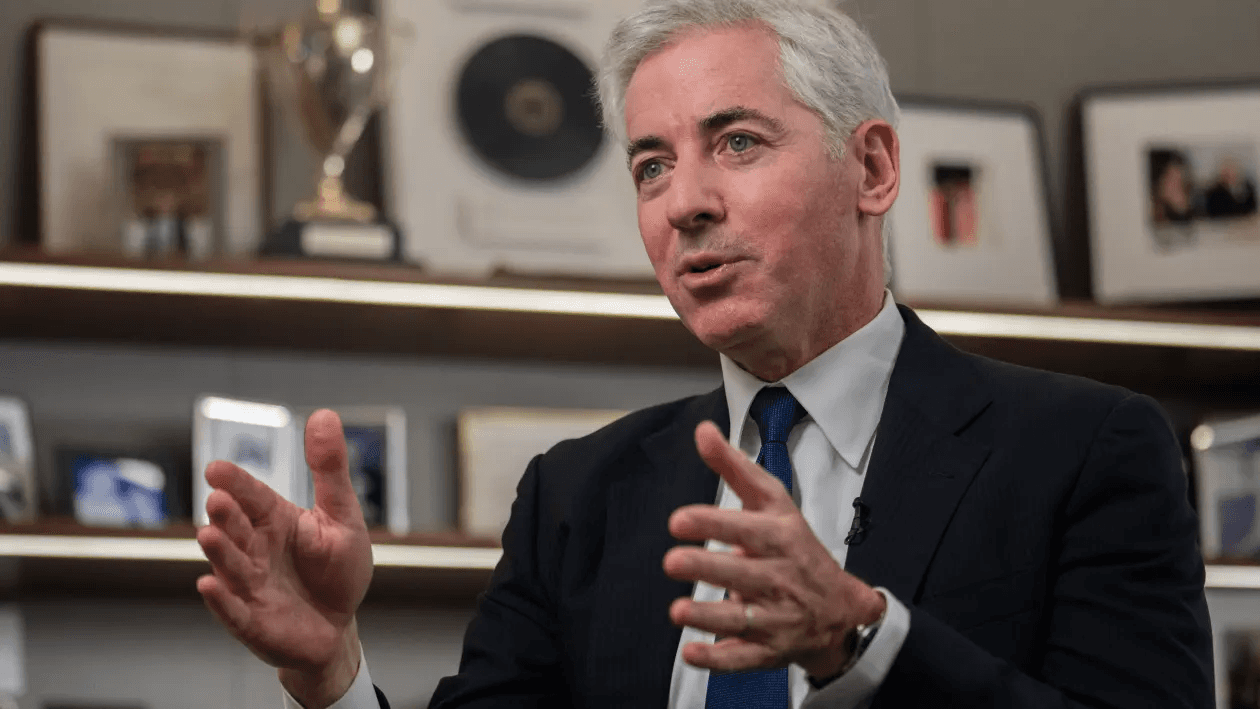

In a bold move, Bill Ackman, CEO of Pershing Square Capital Management, has significantly increased his takeover bid for Howard Hughes Holdings, with a vision to transform the real estate developer into a "modern-day Berkshire Hathaway." This ambitious plan involves acquiring 10 million newly issued shares at $90 each, positioning Pershing Square to own nearly half of the company.

The Proposal

Ackman's latest proposal builds upon his earlier offer in January, where he suggested forming a new Pershing subsidiary to merge with Howard Hughes at $85 per share. The revised deal does not require shareholder approval, regulatory clearances, or financing, allowing it to be completed within weeks. If successful, Ackman will assume the roles of chairman and CEO, with Pershing Square receiving an annual fee of 1.5% of Howard Hughes' equity market capitalization.

A Berkshire Hathaway Model

Inspired by Warren Buffett's transformation of Berkshire Hathaway from a struggling textile company into a $1 trillion conglomerate, Ackman aims to replicate this success. Berkshire's diverse portfolio spans insurance, energy, railroads, and retail, alongside a substantial equity portfolio and over $300 billion in cash. Ackman plans to leverage Pershing Square's resources to turn Howard Hughes into a similarly diversified holding company, acquiring controlling stakes in both private and public companies that meet Pershing Square's business quality criteria.

Continuing Core Operations

Despite the ambitious expansion plans, Howard Hughes will continue to focus on developing and owning "master planned communities" like The Woodlands in Houston and Summerlin in Las Vegas. Ackman views these communities as a strong long-term business, particularly in pro-business markets where they can grow into large cities.

Market Reaction

The news led to a mixed market reaction, with Howard Hughes' shares falling nearly 5% in extended trading after closing up 6.8% at $80.60 earlier in the day. The anticipation of the announcement had driven the earlier increase, reflecting investors' interest in Ackman's vision for the company's future.

Conclusion

Bill Ackman's bid to transform Howard Hughes into a modern Berkshire Hathaway marks a significant shift in the real estate sector, blending traditional property development with diversified holdings. If successful, this strategy could redefine the company's trajectory and potentially create a new model for growth in the industry.

Source:

Image Credit: Jeenah Moon | Bloomberg | Getty Images