Finance

India Surpasses Hong Kong: A New Era in Global Stock Markets

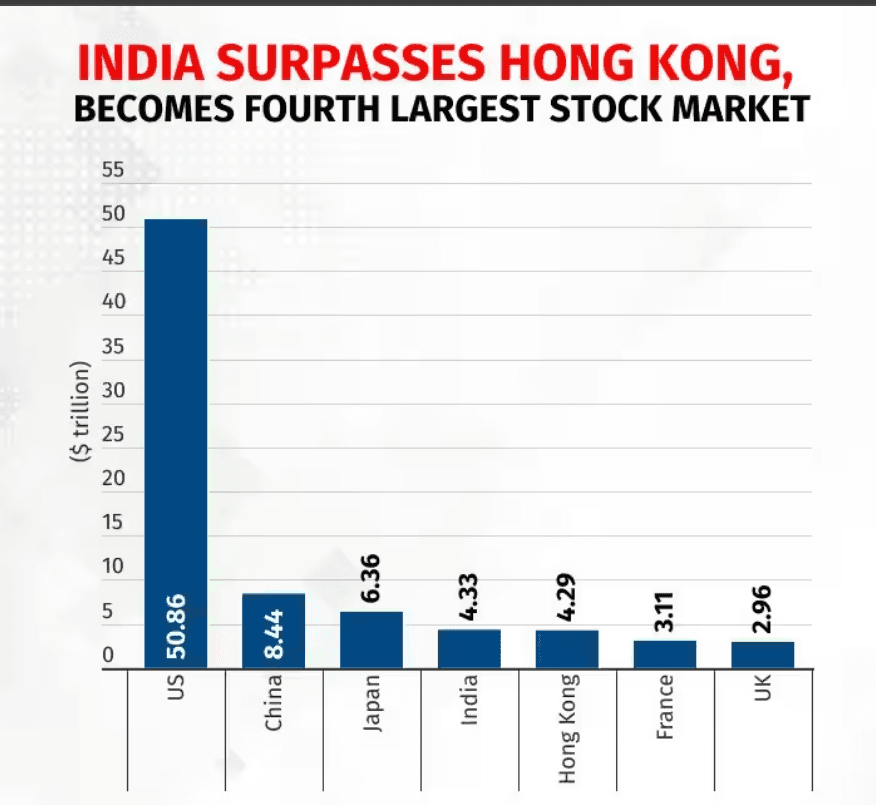

In a significant shift in global financial dynamics, India's stock market has overtaken Hong Kong's to become the fourth-largest in the world. This milestone was achieved when India's market capitalization reached $4.33 trillion, surpassing Hong Kong's $4.29 trillion on January 23, 20241. This development underscores India's growing economic influence and its appeal to global investors.

Key Factors Behind India's Rise

Growing Retail Investor Base: India's stock market has been buoyed by a surge in retail investors. This growth has contributed significantly to the market's expansion, as more individuals participate in the stock market1.

Strong Corporate Earnings: Indian companies have reported robust earnings, attracting both domestic and foreign investors. This has been a crucial factor in the market's recent success1.

Foreign Investment: Overseas funds have poured into Indian stocks, with over $21 billion invested in 2023 alone. This influx of foreign capital has further boosted the market's value1.

Economic Growth Prospects: India's economic growth prospects are promising, with the country expected to experience significant expansion in the coming years. This potential has made India an attractive destination for investors seeking growth opportunities2.

Hong Kong's Challenges

Slumping Chinese Economy: Hong Kong's market has been impacted by the economic slowdown in China. The decline in Chinese equities has led to a decrease in investor confidence in Hong Kong1.

Property Market Issues: The property sector in China has faced significant challenges, contributing to a broader economic downturn that affects Hong Kong's financial markets1.

Rebound Efforts: Despite these challenges, Hong Kong has seen periods of recovery, particularly when China implements stimulus measures. However, these gains are often temporary and subject to broader economic conditions7.

Global Investment Trends

Diversification to India: Hong Kong family offices and global investors are increasingly diversifying their investments to India, recognizing its potential for long-term growth2.

Asia's IPO Market: India's robust IPO pipeline is expected to continue in 2025, with dealmakers anticipating a strong year for new listings in Asia4.

Market Valuations and Outlook

Valuation Multiples: India's stock market trades at a higher valuation compared to Hong Kong, with a one-year forward earnings multiple of over 21, reflecting investor optimism about India's growth prospects6.

Future Outlook: While India's market has shown resilience, it faces challenges such as global economic uncertainties and domestic inflation. However, analysts remain positive about India's long-term potential36.

In conclusion, India's stock market surpassing Hong Kong's marks a significant milestone in global financial markets. As India continues to attract investors with its growth story, it is poised to remain a major player in the global financial landscape.

Sources: