Business

Finance

In a year marked by significant financial milestones, JPMorgan Chase has reported a record profit of $58.5 billion, yet many of its employees are expressing discontent over what they perceive as modest bonuses and pay raises. The bank's decision to offer a mere 2% pay bump and what some consider underwhelming bonuses has sparked dissatisfaction among workers, particularly during a period when Wall Street's bonus season is under scrutiny.

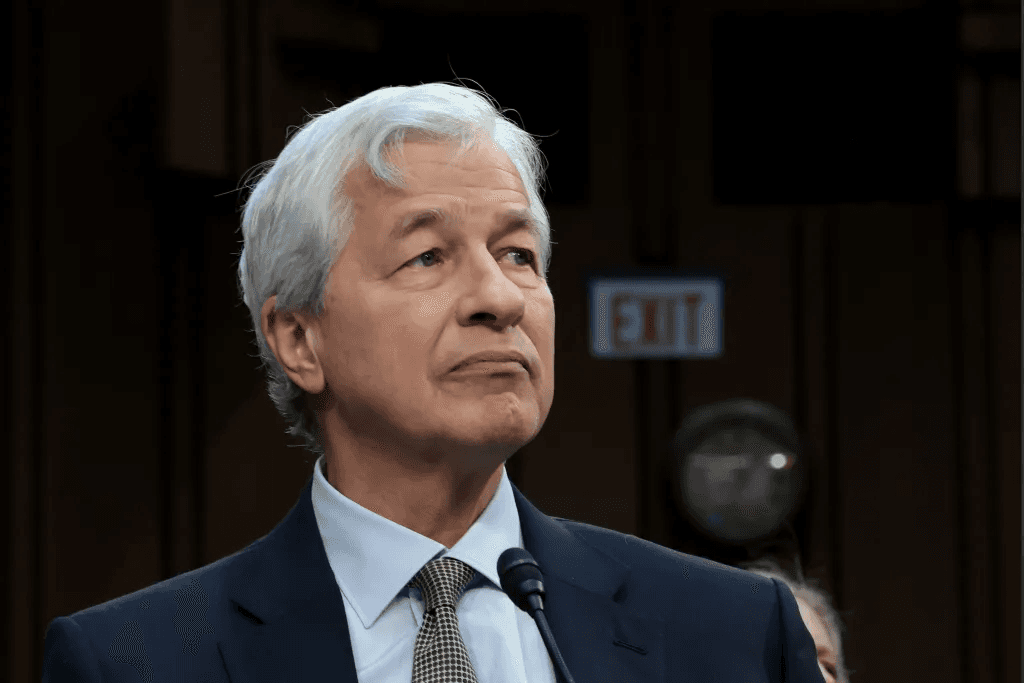

The contrast between the bank's substantial profits and the relatively small increases in employee compensation has raised eyebrows. Jamie Dimon, the bank's chairman and CEO, has been at the helm of JPMorgan Chase as it navigates complex financial landscapes, including mergers and acquisitions that have contributed to its success. Despite these achievements, the perception among some employees is that their contributions are not being adequately recognized or rewarded.

Background on JPMorgan Chase's Financial Performance

JPMorgan Chase is one of the largest financial institutions in the world, with a diverse range of services that include consumer and community banking, corporate and investment banking, and asset management. The bank's ability to generate record profits is a testament to its strategic positioning and operational efficiency. However, the distribution of these profits, particularly in terms of employee bonuses and raises, has become a contentious issue.

Employee Dissatisfaction

The dissatisfaction among JPMorgan Chase employees stems from the belief that their hard work and dedication have not been sufficiently acknowledged. In a year where the bank achieved unprecedented financial success, many expected more substantial bonuses and pay increases. The 2% pay bump, while better than some other industries, falls short of expectations when compared to the bank's overall performance.

Wall Street Bonus Season

The current Wall Street bonus season has been marked by mixed results across different financial institutions. While some banks have offered more generous bonuses, others have been more conservative in their compensation packages. JPMorgan Chase's approach reflects a cautious stance, possibly influenced by broader economic uncertainties and the need to maintain financial stability.

Future Outlook

As JPMorgan Chase looks to the future, it will need to balance its financial goals with employee satisfaction. The bank's success is heavily dependent on the morale and productivity of its workforce. Addressing the concerns of its employees could be crucial in maintaining a competitive edge in the financial sector.

Conclusion

JPMorgan Chase's record profits have highlighted the complexities of balancing financial success with employee compensation. While the bank's achievements are undeniable, the perception of inadequate bonuses and raises has created tension among its workforce. As the financial landscape continues to evolve, finding a balance between profitability and employee satisfaction will be essential for the bank's long-term success.

Source:

Luisa Beltran, Fortune https://fortune.com/2025/01/23/jpmorgan-chase-workers-banker-bonuses-raises-wall-street-bonus-season-mergers/

Image Credit: Courtesy of Win McNamee / Getty Images