Finance

Politics

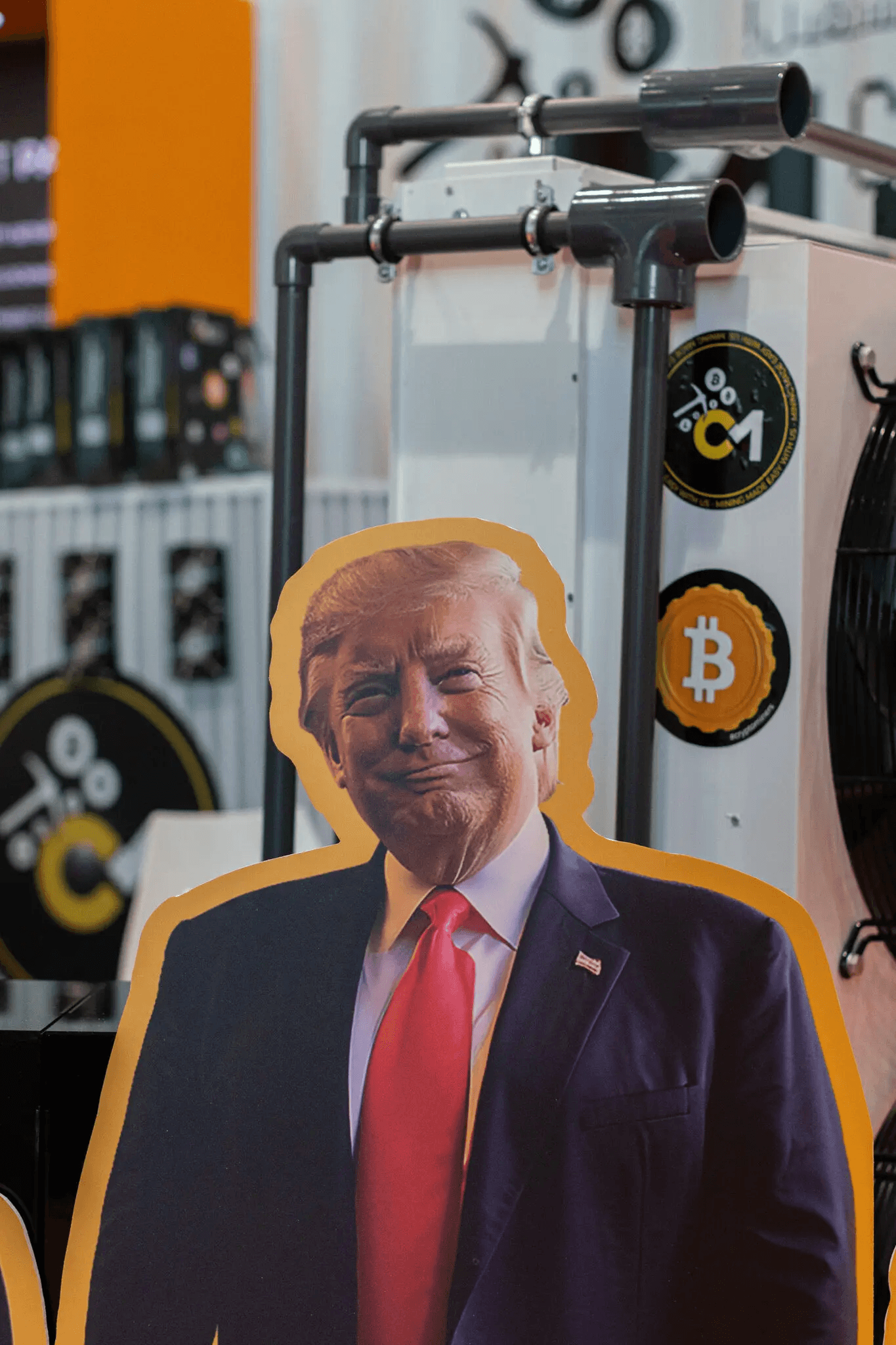

In a dramatic turn of events, the launch of a new cryptocurrency called $Trump by President Trump and his sons has led to a stark divide among investors. While some early traders reaped tens of millions in profits, many others suffered significant losses, highlighting the speculative dangers of the memecoin industry.

The Boom-and-Bust Sequence

On January 17, just three days before President Trump's inauguration, he announced the launch of $Trump on his social media platforms. The news sparked a frenzy, with a crypto wallet securing a massive purchase of 5,971,750 tokens at 18 cents each, just minutes after the announcement. This early buy helped propel the price to a peak of $75 per token, only to crash later, leaving it at around $17.

One early trader, whose identity remains unknown, made a staggering profit of up to $109 million over two days. However, this success came at the expense of over 810,000 wallets that lost money, with cumulative losses exceeding $2 billion. The data does not account for transactions on popular marketplaces that started offering the coin after its price surge, suggesting the actual losses could be even higher.

The Memecoin Industry's Exploitative Pattern

The memecoin industry, largely unregulated, thrives on a pattern where sophisticated traders buy early, inflate prices, and then sell, often leaving retail investors with significant losses. This "pump-and-dump" scheme is legal but has raised concerns among regulators. New York regulators have warned consumers about such practices, noting they can cause substantial financial harm to latecomers.

Regulatory Concerns and Trump's Involvement

Critics argue that President Trump's involvement in these crypto schemes while rolling back regulatory protections is troubling. Corey Frayer, a former crypto adviser to the SEC, expressed concern that Trump's actions could insulate him and his family from enforcement while harming investors.

The Trump Family's Crypto Ventures

This is not the Trump family's first foray into crypto. They have launched World Liberty Financial and are expanding into financial services with TruthFi, offering Bitcoin-related products. However, the $Trump memecoin marked the first time they directly marketed a cryptocurrency to ordinary investors.

The Human Impact

For many investors, including vocal Trump supporters like Shawn M. Whitson, the experience has been disappointing. Whitson initially celebrated the coin's launch but later expressed frustration, calling it "a joke." His story reflects the broader sentiment among those who lost money on the $Trump bet.

Conclusion

The $Trump cryptocurrency saga highlights the speculative nature of the memecoin market and the risks faced by retail investors. While some traders profited handsomely, many others suffered significant financial losses. As the crypto industry continues to evolve, the need for clearer regulations and investor protections becomes increasingly evident.

Source:

Eric Lipton and David Yaffe-Bellany, The New York Times https://www.nytimes.com/2025/02/09/us/politics/trump-crypto-memecoin.html