Finance

Politics

As the U.S. economy continues to show resilience, with a solid jobs report and stable inflation, dark clouds are gathering on the horizon. President Trump's aggressive trade policies, particularly the tariffs imposed on China, Mexico, and Canada, threaten to upset this delicate balance. The question on everyone's mind is whether these tariffs will push the economy into a stagflationary shock—a scenario where economic growth stalls while inflation rises.

In recent weeks, the U.S. has seen a robust jobs market, with 143,000 new positions created in January. Big tech companies like Amazon and Meta are investing heavily in AI infrastructure, further bolstering economic optimism. However, the ongoing trade tensions could soon overshadow these positives. Tariffs have historically led to increased costs for businesses and consumers, which can reignite inflation. If inflation surges, it could prompt the Federal Reserve to reconsider rate hikes, a move that could dampen economic growth.

To better understand the potential impact of these tariffs, Yahoo Finance Executive Editor Brian Sozzi spoke with Torsten Sløk, chief economist at Apollo Global Management. Sløk offered insights into whether tariffs could tip the economy into a short-term recession and send markets into a tailspin. His predictions for the rest of 2025 provide a glimpse into the challenges and opportunities that lie ahead.

The Tariff Conundrum

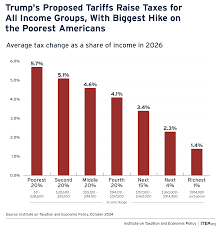

President Trump's trade policies have been a defining feature of his presidency, with tariffs being a key tool in his arsenal. While intended to protect American industries and jobs, tariffs can have unintended consequences. They increase the cost of imported goods, which can lead to higher prices for consumers. This inflationary pressure could force the Fed to raise interest rates, making borrowing more expensive and potentially slowing down economic growth.

Economic Predictions for 2025

As the year unfolds, economists like Sløk are closely watching how these trade tensions evolve. The interplay between tariffs, inflation, and interest rates will be crucial in determining the trajectory of the U.S. economy. If the situation escalates, it could lead to a stagflationary scenario, where economic growth falters while inflation rises—a challenging environment for both policymakers and investors.

In such a scenario, big tech companies might find it harder to maintain their aggressive investment strategies, potentially impacting their ability to drive innovation and create jobs. The resilience of the U.S. economy will be tested as it navigates these complex challenges.

Conclusion

While the U.S. economy remains strong for now, the looming threat of stagflation due to tariffs cannot be ignored. As policymakers and investors look to the future, they must consider the potential risks and opportunities presented by these trade policies. Whether the economy can avoid a stagflationary shock will depend on how effectively these challenges are managed.

Source:

Brian Sozzi, Executive Editor Yahoo Finance https://finance.yahoo.com/video/trump-tariffs-may-trigger-stagflationary-124936662.html

Image Credit: ITEP